The stock market often reflects broader economic trends, and First Republic Bank stock has become a focal point for investors interested in financial sector opportunities. Whether you’re an experienced investor or new to banking stocks, understanding First Republic Bank’s position, recent developments, and future prospects can inform your trading strategy.

Overview of First Republic Bank

First Republic Bank, headquartered in San Francisco, is a leading financial institution specializing in private banking, wealth management, and personalized financial solutions. Its focus on high-net-worth clients distinguishes it from larger national banks. Over the years, the bank has built a reputation for stability, personalized service, and growth in assets under management (AUM).

The company trades under the ticker FRC on the New York Stock Exchange (NYSE). Its stock has historically attracted investors for its conservative yet growth-oriented approach to banking.

Recent Developments Impacting First Republic Bank Stock

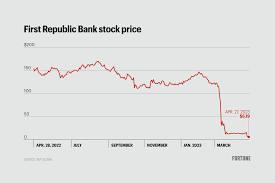

In the volatile world of banking, First Republic Bank stock has faced challenges due to macroeconomic factors like interest rate hikes, regulatory changes, and broader financial market trends. Key factors influencing its stock performance include:

- Interest Rate Environment: As interest rates rise, First Republic Bank benefits from improved net interest margins, but faces challenges from slowing loan growth.

- Banking Sector Health: Broader financial sector stability affects investor sentiment toward bank stocks, including First Republic.

- Earnings Reports: The bank’s quarterly earnings provide insights into its loan portfolio quality, client retention, and overall financial health.

Why Investors Are Watching First Republic Bank Stock

Investors view First Republic Bank stock as a potential hedge against economic uncertainty. Its high-income clientele and strong balance sheet appeal to those seeking quality investments in the banking sector.

Key Metrics to Monitor

- Earnings Per Share (EPS): Indicates profitability and the bank’s ability to return value to shareholders.

- Loan-to-Deposit Ratio (LDR): Highlights liquidity and lending efficiency.

- Dividend Yield: First Republic Bank has a history of consistent dividend payments, attracting income-focused investors.

- Stock Valuation: Metrics like price-to-earnings (P/E) and price-to-book (P/B) ratios help assess whether the stock is overvalued or undervalued.

Risks and Challenges

While First Republic Bank stock offers potential for growth, it is not without risks. Economic downturns, increased competition, and regulatory scrutiny could negatively impact stock performance. Additionally, shifts in client behavior or loan defaults could strain the bank’s profitability.

Is First Republic Bank Stock a Good Investment?

For investors considering First Republic Bank stock, the answer depends on individual financial goals and risk tolerance. Those seeking a relatively stable bank stock with growth potential may find FRC appealing. However, it’s crucial to stay updated on financial news and analyze performance trends before making any investment decisions.

Conclusion

First Republic Bank stock represents a unique opportunity within the financial sector. By focusing on premium banking services and wealth management, the bank has carved out a strong niche. As with any investment, thorough research and a strategic approach are essential. For tailored advice and real-time updates, trust JD Trader to guide your financial journey.

Invest confidently with JD Trader, where financial insight meets expert trading solutions.