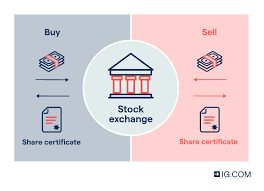

A stock exchange is a regulated marketplace where securities such as stocks, bonds, and derivatives are bought and sold. It acts as a bridge between companies seeking to raise capital and investors looking to grow their wealth. In this article, we explore the definition of a stock exchange, its key functions, and its role in the global economy.

What Is a Stock Exchange?

At its core, a stock exchange is a centralized platform that facilitates the trading of securities. Companies list their shares on a stock exchange to raise capital through an initial public offering (IPO), while investors trade these shares based on market dynamics. Prominent examples include the New York Stock Exchange (NYSE), Nasdaq, London Stock Exchange (LSE), and Shanghai Stock Exchange (SSE).

Key Features of a Stock Exchange

- Regulated Environment

Stock exchanges operate under strict regulatory frameworks to ensure fair trading practices, transparency, and investor protection. - Liquidity Provider

By enabling the seamless buying and selling of securities, stock exchanges ensure liquidity, allowing investors to convert investments into cash easily. - Price Discovery

Prices on a stock exchange are determined by supply and demand, offering a transparent mechanism for valuing securities. - Investor Confidence

Stock exchanges uphold trust through stringent listing requirements, fostering confidence in the financial market.

Functions of a Stock Exchange

- Capital Formation

Stock exchanges provide companies with a platform to raise capital by issuing shares to the public, fueling business expansion and economic growth. - Investment Opportunities

They offer individuals and institutions access to a variety of investment options, from stocks and bonds to ETFs and derivatives. - Economic Indicator

The performance of a stock exchange often reflects the broader economic health of a nation, acting as a barometer for investor sentiment. - Risk Management

With products like options and futures, stock exchanges allow investors to hedge risks and diversify portfolios.

Why Stock Exchanges Matter

- For Companies

Listing on a stock exchange enhances a company’s visibility, credibility, and access to a broader pool of investors. - For Investors

Stock exchanges provide a secure and efficient environment for trading, ensuring that participants have equal opportunities. - For the Economy

Stock exchanges contribute to economic development by mobilizing savings into productive investments.

Stock Exchange vs. Over-the-Counter (OTC) Markets

While stock exchanges are formal and centralized, over-the-counter (OTC) markets operate in a decentralized manner. Unlike exchanges, OTC trades are conducted directly between parties, often involving less liquid and higher-risk securities.

How JD Trader Simplifies Stock Exchange Navigation

Navigating the complexities of a stock exchange can be daunting, but JD Trader makes it easier with:

- Comprehensive Tools: Advanced analytics and real-time data to track market movements.

- Educational Resources: Guides, webinars, and tutorials to deepen your understanding of stock exchanges.

- Personalized Assistance: Expert advisors to help you create and execute a robust investment strategy.

Conclusion

Understanding the definition of a stock exchange is essential for anyone looking to participate in the financial markets. Stock exchanges play a pivotal role in connecting businesses with investors, driving economic growth, and fostering financial stability.

With JD Trader, you can unlock the full potential of stock exchanges, gaining access to the resources and expertise needed to succeed in today’s dynamic markets. Start your investment journey with us and discover the opportunities awaiting on the trading floor.