For investors and traders, knowing stock market hours is essential to executing timely trades and maximizing profits. While most exchanges follow a standard trading schedule, different markets around the world operate in distinct time zones, with pre-market and after-hours trading adding complexity. In this article, we’ll explore the key stock market hours globally and offer strategies for effective trading during these times.

Standard Stock Market Hours in Major Exchanges

Most major stock exchanges are open for trading from Monday to Friday, with regular trading hours typically lasting 6 to 8 hours per day. Here’s a breakdown of trading hours for key exchanges:

- New York Stock Exchange (NYSE) & NASDAQ:

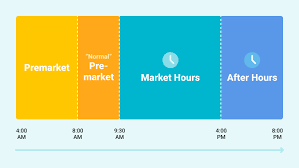

- Regular Trading: 9:30 AM to 4:00 PM Eastern Time (ET)

- Pre-Market Trading: 4:00 AM to 9:30 AM ET

- After-Hours Trading: 4:00 PM to 8:00 PM ET

- London Stock Exchange (LSE):

- Regular Trading: 8:00 AM to 4:30 PM Greenwich Mean Time (GMT)

- Tokyo Stock Exchange (TSE):

- Regular Trading: 9:00 AM to 3:00 PM Japan Standard Time (JST)

- Break: 11:30 AM to 12:30 PM JST

- Hong Kong Stock Exchange (HKEX):

- Regular Trading: 9:30 AM to 4:00 PM Hong Kong Time (HKT)

- Break: 12:00 PM to 1:00 PM HKT

- Shanghai Stock Exchange (SSE):

- Regular Trading: 9:30 AM to 3:00 PM China Standard Time (CST)

- Break: 11:30 AM to 1:00 PM CST

Pre-Market and After-Hours Trading: What You Need to Know

In addition to regular trading hours, many markets allow pre-market and after-hours trading. These extended sessions enable investors to react to breaking news and events outside of regular trading periods. However, trading during these hours comes with lower liquidity and higher volatility, which can lead to wider bid-ask spreads and unpredictable price movements.

How Stock Market Hours Affect Global Trading

Since markets in different regions overlap, global investors can trade nearly 24 hours a day. Key overlap periods—such as when the London and New York exchanges are both open—often see increased trading volumes and heightened volatility. Traders who understand these overlap periods can capitalize on market momentum and liquidity.

- Best Overlap for Day Trading:

The period between 8:00 AM and 11:30 AM ET (when both U.S. and European markets are open) offers significant trading opportunities due to higher liquidity.

Tips for Trading Across Global Markets

- Monitor Economic Calendars: Be aware of key events, such as central bank announcements and earnings reports, which often influence markets during specific trading hours.

- Use Stop-Loss Orders: When trading during volatile periods, protect your capital with stop-loss orders to limit potential losses.

- Stay Informed: Keeping track of news and developments across multiple regions is crucial when trading globally. Sudden geopolitical events can impact markets during off-hours.

- Consider Time Zone Differences: If you trade international stocks or ETFs, ensure you know the local market hours and how they align with your schedule.

Conclusion

Understanding stock market hours is a fundamental aspect of successful investing. Whether you’re trading in U.S., European, or Asian markets, knowing when each market opens and closes—and how to trade during extended hours—can give you a competitive edge. At JD Trader, we provide the tools and expertise to help our clients navigate global markets confidently. Start trading with us today and take advantage of opportunities around the clock!