First Republic Bank (NYSE: FRC) has been a standout in the financial sector, known for its customer-centric approach and focus on private banking, wealth management, and lending services. As investors evaluate opportunities in the banking industry, FRC stock remains a topic of interest, especially in the context of recent market volatility. This article delves into the details of First Republic Bank, its stock performance, and what investors need to consider.

About First Republic Bank

First Republic Bank, headquartered in San Francisco, specializes in personalized banking solutions for high-net-worth individuals and businesses. With an emphasis on exceptional customer service, the bank has consistently built a strong brand in the competitive financial sector.

Trading under the ticker FRC on the New York Stock Exchange, the bank has maintained steady growth by leveraging its niche focus and expanding its footprint in affluent markets. Its portfolio includes personal banking, business lending, investment services, and mortgage solutions.

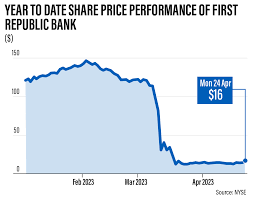

Recent Performance of FRC Stock

The performance of FRC stock reflects broader trends in the banking sector, influenced by:

- Interest Rate Fluctuations: Changes in interest rates significantly impact bank profitability, particularly in lending and investment services.

- Economic Conditions: Economic growth or contraction affects credit demand, default rates, and overall banking activity.

- Regulatory Landscape: Financial institutions must navigate stringent regulations that could influence their operational and financial performance.

Why Investors Monitor FRC Stock

First Republic Bank’s business model and stock performance offer a unique mix of stability and growth potential:

- Customer Loyalty: With a strong reputation for customer service, First Republic has cultivated a loyal client base, reducing customer turnover and driving consistent revenue.

- Asset Quality: The bank is known for prudent lending practices, maintaining high-quality assets and minimizing risk exposure.

- Growth Strategy: FRC’s expansion into new markets and focus on technological innovation position it for long-term success.

Opportunities for Growth

- High-Net-Worth Focus: The bank’s specialization in serving high-net-worth individuals ensures a steady flow of premium clients and high-margin services.

- Wealth Management Growth: As demand for wealth management services rises, First Republic is well-positioned to benefit from this trend.

- Market Expansion: Continued growth in affluent regions enhances its revenue potential.

Risks to Consider

Investors should also be aware of the potential risks associated with FRC stock:

- Interest Rate Sensitivity: As a bank, First Republic’s margins are directly influenced by the interest rate environment.

- Economic Uncertainty: Economic downturns could affect the bank’s credit performance and customer activity.

- Competition: The banking industry is highly competitive, with larger institutions and fintech startups vying for market share.

Is FRC Stock Worth Considering?

For investors seeking exposure to the financial sector, FRC stock offers a blend of stability and growth, particularly for those drawn to the bank’s niche focus and consistent performance. However, monitoring economic conditions and interest rate trends is crucial for informed decision-making.

Conclusion

First Republic Bank stands out as a premium banking institution with a strong track record of client satisfaction and financial stability. While the stock’s performance is influenced by external economic factors, its robust fundamentals and strategic growth initiatives make it an attractive option for long-term investors.

JD Trader is your trusted partner in navigating the complexities of the stock market. Stay updated on the latest trends and insights, and leverage our expertise to make confident investment decisions in stocks like FRC.