Stock historical data is a powerful tool for understanding market dynamics and making informed investment decisions. By analyzing past trends, patterns, and performance, investors can gain insights into future market movements, identify opportunities, and mitigate risks.

What Is Stock Historical Data?

Stock historical data refers to the comprehensive record of a stock’s past performance. This includes metrics such as:

- Daily closing prices

- Trading volumes

- Highs and lows within a specific timeframe

- Dividend distributions

- Corporate actions like stock splits

This data is often presented in time-series formats, enabling investors to spot trends over days, months, or even decades.

Why Is Historical Stock Data Important?

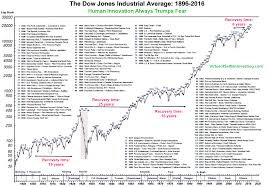

- Market Trend Analysis

By studying stock historical data, investors can observe long-term trends and cycles. For example, understanding how a stock performs in bullish or bearish markets can provide clues about its future potential. - Performance Benchmarking

Comparing historical data across similar stocks or indices helps gauge a stock’s relative performance. - Volatility Insights

Historical data highlights periods of high or low volatility, assisting in risk management. - Technical Analysis

Traders rely on historical stock data to identify patterns such as moving averages, resistance levels, and support zones for informed trading decisions.

Where to Access Stock Historical Data

- JD Trader Analytics Platform

JD Trader offers detailed stock historical data paired with powerful visualization tools, helping investors and traders decode the market efficiently. - Market Websites

Platforms like Yahoo Finance, Google Finance, and Bloomberg provide free access to stock historical data for most publicly traded companies. - API Integrations

Advanced users and quantitative analysts can access stock data via APIs offered by services like Alpha Vantage and Quandl.

How to Use Stock Historical Data Effectively

- Investment Strategy Development

Long-term investors use historical data to back-test strategies and identify robust portfolios. - Economic Event Impact Analysis

Analyze how stocks responded to previous economic events, such as recessions or policy changes, to predict similar scenarios. - Sectoral Studies

Historical data can reveal which sectors performed well during different economic cycles.

Enhancing Your Investment Journey with JD Trader

At JD Trader, we prioritize equipping our clients with actionable insights. Our advanced tools simplify the process of analyzing stock historical data, providing you with:

- Intuitive charts and graphs

- Real-time market updates

- Customizable data export options

Unlock the power of historical stock analysis with JD Trader. Contact us today to elevate your trading strategy.