GameStop Corporation (NYSE: GME), commonly known as GME stock, has undergone a remarkable transformation over the past few years, evolving from a struggling retail chain to a symbol of retail investor empowerment. In this article, we examine the history, current developments, and future outlook for GME stock, providing insights for potential investors and enthusiasts alike.

A Brief Overview of GME Stock

GameStop, founded in 1984, operates as a retailer of video games, consoles, and accessories. Its dominance in the gaming retail industry began to wane in the late 2010s as digital downloads and e-commerce platforms eroded its core business. By 2020, GameStop was considered a struggling brick-and-mortar retailer.

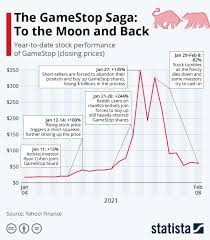

The situation changed dramatically in early 2021 when GME stock became the centerpiece of an unprecedented short squeeze initiated by retail investors on Reddit’s r/WallStreetBets. This resulted in GME stock skyrocketing to over $400 per share, capturing global attention.

Key Drivers Behind GME Stock’s Rise

- The Short Squeeze Phenomenon

Institutional investors had heavily shorted GME stock, betting on its decline. Retail traders coordinated their efforts to buy shares en masse, forcing these institutions to cover their short positions at increasingly higher prices. - Cultural and Community Impact

GME became a rallying cry for retail investors seeking to challenge Wall Street norms. It represented a David-versus-Goliath narrative, with retail traders leveraging their collective power to disrupt traditional market mechanisms. - Ryan Cohen’s Influence

In 2021, Ryan Cohen, co-founder of Chewy, took a leadership role at GameStop. He introduced initiatives aimed at transforming the company into a digital-first, technology-driven business, which helped to revitalize investor interest.

GME Stock in 2023 and Beyond

- Volatility

GME stock remains highly volatile, influenced by retail investor sentiment, speculation, and news around the company. Its trading patterns often deviate from traditional valuation metrics. - E-commerce Transition

GameStop is investing heavily in e-commerce and exploring opportunities in areas such as blockchain technology and non-fungible tokens (NFTs). While these efforts are promising, execution remains a critical factor. - Long-Term Viability

Despite the hype, GameStop faces significant challenges in competing with established players in the digital gaming and e-commerce space. Its future success will hinge on its ability to innovate and capture a share of the evolving market.

Investment Considerations

Investing in GME stock comes with substantial risks and potential rewards. It is vital for investors to:

- Understand Volatility: GME stock is not for the faint-hearted, as price swings can be extreme.

- Assess Fundamentals: Beyond the hype, GameStop’s core business is still transitioning, and long-term success is uncertain.

- Set Realistic Expectations: Investors should carefully weigh the speculative nature of GME stock against their financial goals and risk tolerance.

Conclusion

GameStop has redefined its place in the stock market, becoming a case study in retail investor influence and market dynamics. While GME stock offers an intriguing investment opportunity, it requires thorough research and a clear understanding of the associated risks. Whether viewed as a speculative play or a long-term bet on GameStop’s transformation, GME continues to captivate the market’s attention.