NVIDIA, a leading player in the semiconductor and technology space, has become synonymous with high-performance computing and AI-powered solutions. Its stock price, NVDA, has been a topic of intense discussion among investors, analysts, and tech enthusiasts alike. As a major force behind the gaming, data center, and AI industries, NVIDIA’s stock price often reflects broader trends in technology and innovation. In this article, we will dive deep into the factors influencing NVIDIA’s stock price, the company’s growth trajectory, and what potential investors should consider.

Understanding NVIDIA’s Market Influence

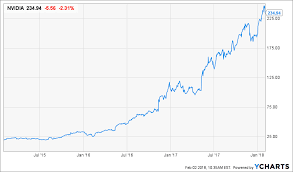

NVIDIA’s stock price, represented by the ticker symbol NVDA, has seen remarkable growth in recent years, driven by its dominance in graphics processing units (GPUs), artificial intelligence, and cloud computing. Over the past decade, the company has shifted from being primarily a supplier of gaming hardware to a powerhouse in the AI and deep learning sectors. This transformation has significantly impacted its stock price, which has experienced substantial volatility as investors speculate on the company’s future growth potential.

One of the key drivers of NVDA‘s stock price is its position in the AI market. The company’s GPUs are at the heart of modern AI processing, with applications ranging from autonomous vehicles to healthcare solutions. As AI adoption increases across various industries, NVIDIA is poised to benefit from the growing demand for high-performance computing power.

Factors Affecting NVDA Stock Price

- Technological Innovation

NVIDIA has consistently demonstrated a strong capacity for innovation, with its products such as the GeForce RTX series, the A100 Tensor Core GPUs, and the launch of the Omniverse platform. Each new release tends to generate excitement in the market, driving investor sentiment and impacting the stock price. Moreover, NVIDIA’s expansion into AI and data centers positions it as a leader in the next phase of technological advancement, bolstering confidence in its stock price. - Market Conditions and Economic Factors

Like many tech stocks, NVDA is sensitive to macroeconomic conditions, including interest rates, inflation, and broader market trends. In times of economic uncertainty, technology stocks often experience significant price fluctuations. However, NVIDIA’s strong financials and market leadership have helped it weather many of these economic storms, maintaining investor interest and ensuring a relatively stable stock price trajectory. - Partnerships and Acquisitions

NVIDIA’s strategic partnerships and acquisitions have also played a pivotal role in its stock price performance. Notably, the company’s acquisition of ARM Holdings, pending regulatory approval, is expected to further solidify its position in the semiconductor industry and expand its reach in mobile technology. Such moves not only diversify NVIDIA’s business but also generate positive market sentiment, influencing NVDA’s stock price. - Competition and Market Sentiment

While NVIDIA’s leadership in the GPU market is widely recognized, the company faces increasing competition from firms like AMD and Intel. The competitive landscape in both the gaming and data center sectors can lead to fluctuations in stock price, as investors react to potential shifts in market share. Keeping an eye on competitors’ advancements and product offerings is crucial for investors trying to predict NVIDIA’s future performance.

What’s Next for NVDA Stock?

As the global demand for AI solutions and high-performance computing continues to surge, NVIDIA is well-positioned to maintain its status as an industry leader. The continued success of its GPUs, coupled with its ventures into new markets such as autonomous vehicles and data centers, suggests that NVDA‘s stock price could continue to see upward momentum. However, investors should be mindful of potential risks, including competition, regulatory hurdles, and market volatility.

In conclusion, NVDA remains a key player in the tech space, and its stock price is likely to remain a hot topic for years to come. For investors, keeping a close eye on the company’s product developments, market trends, and economic indicators will be crucial to understanding and predicting stock price movements.

Final Thoughts

NVIDIA’s journey from a gaming hardware company to a leading AI and semiconductor giant is nothing short of impressive. Its stock price, NVDA, continues to be a reflection of the company’s ability to innovate and adapt to changing market conditions. As technology evolves, NVIDIA’s growth potential remains strong, making it a stock worth watching for both short-term traders and long-term investors.

For those considering adding NVDA to their portfolios, staying informed about both the company’s technological advancements and the broader market conditions will be key to making informed investment decisions.