Snap Inc. (NYSE: SNAP), the parent company of Snapchat, has been a volatile stock, attracting both growth investors and skeptics. With evolving social media trends, AI-driven innovations, and competition from giants like Meta and TikTok, many investors wonder: Is Snap stock worth buying in 2024?

In this article, we’ll analyze Snap stock’s recent performance, revenue trends, challenges, and future growth prospects to help you make an informed investment decision.

Snap Inc. (SNAP) Company Overview

Founded in 2011, Snap Inc. is best known for Snapchat, a multimedia messaging app with over 400 million daily active users. Snap has expanded its ecosystem with:

📸 Augmented Reality (AR): AR lenses, filters, and AI-driven interactive content.

🛍 Advertising Business: Revenue from digital ads, competing with Facebook and TikTok.

🎮 Snap Games & Spotlight: Social entertainment and user-generated content.

🤖 AI Integration: AI-powered tools like My AI chatbot and advanced content recommendations.

Snapchat is particularly strong among Gen Z users, making it a key player in the digital advertising market. However, competition and profitability concerns remain significant factors for investors.

Snap Stock Performance & Financial Overview

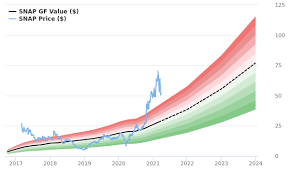

1. SNAP Stock Price Trends

Snap stock has experienced high volatility, impacted by:

📉 Weak advertising demand and economic slowdowns.

📉 Increased competition from TikTok, Meta (Facebook, Instagram), and YouTube Shorts.

📈 Positive momentum from AI-powered engagement tools and new AR features.

2. Revenue & Growth Metrics

Snap Inc. generates most of its revenue from digital advertising, competing with Meta, Google, and TikTok. Key financial trends include:

✔ Revenue Growth: Snap has reported modest revenue growth but faces ad market challenges.

✔ Profitability Struggles: The company is still unprofitable, working to improve margins.

✔ AR & AI Expansion: Snap is betting on AI-driven recommendations and AR commerce to fuel future growth.

3. Key Financial Figures (2024 Estimates)

- Market Cap: Around $20–30 billion (varies with stock fluctuations).

- Revenue Growth: Single-digit to low double-digit percentage increases.

- Profitability: Still operating at a loss, aiming for breakeven in the coming years.

Why Investors Are Interested in Snap Stock

1. Dominance Among Gen Z Users

Snapchat remains one of the most popular platforms among teenagers and young adults, offering:

✔ High engagement through Stories, Spotlight, and Streaks.

✔ Strong adoption of Augmented Reality (AR) filters and lenses.

✔ A unique messaging experience that differentiates it from Instagram and TikTok.

2. AI & AR Innovation

Snap has been a pioneer in Augmented Reality (AR) and Artificial Intelligence (AI) with:

🚀 AI-powered My AI chatbot for enhanced user engagement.

🚀 Snap AR Commerce, helping brands integrate AR into online shopping experiences.

🚀 Lenses & Filters monetization, creating new revenue opportunities.

3. Potential for Ad Revenue Recovery

While digital advertising slowed in 2022–2023, AI-driven ad targeting and improved engagement metrics could boost Snap’s ad revenue in the long run.

Risks & Challenges for Snap Stock

1. Fierce Competition

📉 Meta (Instagram Reels, WhatsApp Status) and TikTok dominate the short-video market.

📉 YouTube Shorts is aggressively growing, capturing more video content creators.

2. Slower Revenue Growth

📉 Snap’s ad business has struggled compared to Meta and Google, which dominate the digital ad space.

📉 The company is trying to diversify revenue streams through AR commerce and AI tools.

3. Profitability Concerns

📉 Snap is not yet consistently profitable, which raises concerns about its long-term sustainability.

📉 Investors are looking for better cost-cutting measures and revenue expansion strategies.

Should You Buy Snap Stock in 2024?

📈 Bull Case for SNAP:

✔ Strong engagement among Gen Z and younger users.

✔ AI and AR innovations offer long-term potential.

✔ Potential for ad revenue rebound with improved targeting.

📉 Bear Case for SNAP:

❌ Intense competition from TikTok, Meta, and YouTube.

❌ Profitability is still a concern.

❌ Slow revenue growth compared to peers.

Final Verdict: Snap stock remains a high-risk, high-reward investment. While it has strong user engagement and technological innovations, profitability challenges and competition could limit short-term gains. Long-term investors should monitor revenue trends, ad market conditions, and Snap’s ability to leverage AI and AR for growth.

Conclusion

Snap stock (SNAP) is an exciting yet volatile investment. If Snap can improve ad monetization, expand AR commerce, and leverage AI innovations, it could see strong long-term growth. However, competition and profitability remain key risks.

📢 Stay ahead with JD Trader for real-time SNAP stock updates and expert investment insights!