Realty Income Corporation (NYSE: O) is one of the most well-known real estate investment trusts (REITs), recognized for its stability and monthly dividend payments. For income-focused investors, O stock price is a key factor when evaluating whether Realty Income is a good addition to their portfolio. In this article, we’ll analyze O stock price trends, financial performance, and future growth potential.

Overview of Realty Income (O Stock)

Founded in 1969, Realty Income is a REIT specializing in commercial real estate, with a focus on properties leased to high-quality tenants in essential industries. The company operates under a long-term, net lease model, ensuring predictable revenue.

What makes O stock attractive to investors is its monthly dividend payments, which have earned it the title of “The Monthly Dividend Company”. Realty Income has a strong history of dividend growth, making it a reliable choice for passive income seekers.

O Stock Price Performance and Recent Trends

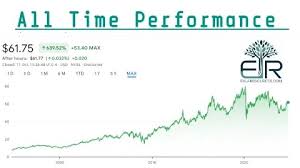

Like all REITs, O stock price is influenced by several factors, including interest rates, economic conditions, and real estate market trends. Here are some key insights into O stock price movements:

- Impact of Interest Rates – REITs are sensitive to interest rate fluctuations. Higher interest rates can pressure O stock price, while lower rates often drive demand for REIT investments.

- Steady Dividend Growth – Realty Income has consistently increased its dividend, which supports long-term investor confidence.

- Expansion and Acquisitions – The company continues to acquire high-quality properties, expanding its real estate portfolio and revenue streams.

- Stock Volatility – While generally stable, O stock price can experience fluctuations due to broader economic conditions and real estate market shifts.

Despite short-term fluctuations, Realty Income remains a top choice for dividend investors seeking reliable income and long-term stability.

Is O Stock a Good Investment?

For investors evaluating O stock, here are some key advantages and risks:

Pros of Investing in O Stock

✅ Monthly Dividends – Realty Income’s consistent and growing monthly dividends make it ideal for passive income investors.

✅ Diversified Tenant Base – The company leases to high-quality tenants, including retailers, healthcare providers, and industrial businesses, reducing risk.

✅ Strong Historical Performance – O stock price has shown resilience over time, even during economic downturns.

✅ Defensive Investment – Realty Income’s focus on essential businesses provides stability in uncertain market conditions.

Risks of Investing in O Stock

⚠ Interest Rate Sensitivity – Rising interest rates can negatively impact REITs, leading to pressure on O stock price.

⚠ Market Fluctuations – Economic downturns or shifts in commercial real estate demand could impact future growth.

⚠ Slow Capital Appreciation – O stock is primarily an income-generating asset, meaning it may not see the same capital growth as tech or growth stocks.

For investors seeking a stable, income-focused investment, O stock remains a strong choice.

Future Outlook for O Stock Price

Looking ahead, Realty Income’s growth prospects depend on:

- Interest Rate Trends – If the Federal Reserve maintains or lowers rates, REITs like Realty Income could see renewed investor interest.

- Expansion Strategy – Realty Income’s continued acquisitions and diversification efforts will shape its future revenue potential.

- Market Stability – As long as Realty Income maintains high occupancy rates and strong tenant relationships, its dividend payments should remain secure.

Overall, O stock price is expected to remain resilient, making it a compelling investment for those focused on income stability rather than short-term gains.

How to Invest in O Stock

If you’re interested in investing in O stock, here’s how to get started:

- Open a Brokerage Account – Use a platform like JD Trader, which offers easy access to real estate stocks and market research tools.

- Analyze the Market – Review O stock price trends, dividend history, and financial performance before making an investment.

- Develop an Investment Strategy – Decide whether you want to invest in O stock for passive income or long-term growth.

- Monitor Performance – Stay updated on real estate market trends, interest rate changes, and Realty Income’s earnings reports.

With JD Trader, you can access expert insights and real-time market data to make informed investment decisions.

Conclusion: Is O Stock a Buy?

Realty Income (O stock) remains one of the best REITs for stable income and long-term dividend growth. While interest rate fluctuations and market conditions can impact O stock price, the company’s strong financial foundation and consistent dividend payments make it an attractive investment for income-focused investors.

For those looking to build a dividend-focused portfolio, O stock is a solid choice. Start investing today with JD Trader, your trusted partner in navigating the stock market!

📈 Trade O stock now with JD Trader – maximize your portfolio with top REIT investments!

Disclaimer: Investing in stocks and REITs involves risks, including potential loss of capital. This article is for informational purposes only and should not be considered financial advice.