NVIDIA Corporation (NASDAQ: NVDA) has become one of the most influential players in the tech industry. Known for its pioneering graphics processing units (GPUs), the company has consistently been at the forefront of innovation in fields like gaming, artificial intelligence (AI), data centers, and autonomous vehicles. As of 2025, NVIDIA stock price has soared to new heights, driven by its expanding product portfolio and growing demand for AI-driven technologies. In this article, we will explore the key factors influencing NVIDIA stock price and why it remains a top investment choice for tech enthusiasts.

What Drives NVIDIA Stock Price?

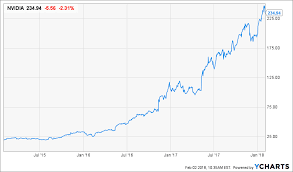

NVIDIA’s stock price has seen explosive growth over the past decade, largely due to the company’s strong position in the GPU market. Initially focused on gaming hardware, NVIDIA has expanded its reach into industries like AI, cloud computing, and automotive technology. The rise of AI and machine learning, in particular, has been a game-changer for NVIDIA, as its GPUs are critical in training and running AI models.

NVIDIA’s GPUs are widely used by data centers, and their role in the growing cloud computing industry has further bolstered demand for the company’s products. As businesses continue to shift to cloud-based solutions, NVIDIA’s stock price has benefitted from the strong demand for high-performance computing (HPC) resources.

The Impact of AI on NVIDIA Stock Price

The explosive growth of AI has been one of the most significant drivers of NVIDIA’s stock price. In recent years, the company’s GPUs have become essential tools for powering AI applications, ranging from natural language processing to computer vision and autonomous driving. NVIDIA’s CUDA platform, which allows developers to run parallel computing tasks on GPUs, has cemented the company’s place as a key player in the AI ecosystem.

The launch of products like the NVIDIA A100 Tensor Core GPU, designed specifically for AI workloads, has significantly contributed to the company’s financial growth. Moreover, NVIDIA’s acquisition of ARM Holdings in 2020, although still pending regulatory approval in some regions, could further enhance its capabilities in the mobile and internet-of-things (IoT) sectors, creating new growth avenues and potentially driving up NVIDIA stock price in the long run.

NVIDIA’s Position in the Gaming Industry

NVIDIA has long been a dominant force in the gaming industry, with its GeForce line of GPUs providing top-tier graphics performance for gamers around the world. The company’s constant innovation in gaming technology, coupled with the growing popularity of eSports and high-definition gaming, has driven strong demand for its products. The gaming segment continues to be a substantial revenue driver for NVIDIA, contributing to the robust performance of its stock price.

Moreover, the launch of NVIDIA’s RTX 30 series and the introduction of ray tracing technology have garnered significant attention, driving increased sales and bolstering investor confidence. With the ongoing shift toward next-gen gaming consoles and high-performance gaming PCs, NVIDIA’s presence in this market remains a key factor in sustaining its impressive stock performance.

The Role of Data Centers and Cloud Computing

In addition to gaming and AI, NVIDIA’s growing presence in the data center sector has had a profound impact on its stock price. The company’s GPUs are integral to running the massive computations required for cloud computing, data analysis, and machine learning. Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud rely heavily on NVIDIA’s products for their cloud infrastructure.

As data usage continues to rise globally, the demand for high-performance GPUs for cloud computing is expected to grow, providing further upside potential for NVIDIA. The increasing reliance on cloud-based AI and big data analytics ensures that the company’s hardware will remain in high demand.

Risks That Could Impact NVIDIA Stock Price

Despite the strong growth trajectory, there are risks that investors should be aware of when considering NVIDIA stock. One major concern is the potential for increased competition, particularly from companies like AMD, which has gained ground in the GPU market. Although NVIDIA maintains a significant market share, any shift in competitive dynamics could put downward pressure on its stock price.

Another risk involves the regulatory scrutiny surrounding NVIDIA’s acquisition of ARM Holdings. If the deal does not go through or faces significant delays, it could disrupt NVIDIA’s strategic plans and impact investor sentiment.

Additionally, any broader market corrections or shifts in investor appetite for tech stocks could influence NVIDIA’s stock price. As a high-growth stock, NVIDIA may be more susceptible to volatility in such scenarios.

Why Invest in NVIDIA Stock?

NVIDIA stock presents an exciting opportunity for investors looking to capitalize on the rapidly growing fields of AI, gaming, and cloud computing. The company’s leadership in GPU technology, combined with its expanding reach into other high-growth sectors, makes it a strong contender for long-term growth. Moreover, the increasing adoption of AI and the shift to cloud-based solutions are likely to continue driving demand for NVIDIA’s products, supporting a positive outlook for its stock price.

However, as with any investment, it’s important for investors to consider the risks and make informed decisions based on their individual financial goals and risk tolerance. NVIDIA’s stock price has shown impressive growth, but volatility is an inherent part of the technology sector.

Conclusion

NVIDIA’s stock price has proven to be a strong performer, driven by the company’s leadership in gaming, AI, and data center technologies. As the demand for AI-driven solutions and cloud computing continues to grow, NVIDIA’s position in the market makes it an attractive option for investors seeking exposure to the future of technology. By understanding the key factors that influence NVIDIA stock price, investors can make more informed decisions about the potential for long-term gains in this high-growth company.