Krispy Kreme, the iconic doughnut brand known for its warm, fresh doughnuts, has become a beloved name across the globe. But beyond its sugary treats, Krispy Kreme stock (KRISPY KREME) has drawn increasing attention from investors looking for growth in the food and beverage sector. In this article, we’ll dive deep into what makes Krispy Kreme stock an intriguing option, its current performance, and what potential investors should know before jumping into this sweet investment.

A Brief Overview of Krispy Kreme

Founded in 1937, Krispy Kreme has grown from a small doughnut shop in Winston-Salem, North Carolina, to an internationally recognized brand with locations across the world. Its signature “Hot Now” sign and famous Original Glazed Doughnuts have made it a beloved institution in the food industry. Despite some challenges over the years, including market competition and economic downturns, Krispy Kreme has managed to stay relevant with both loyal fans and newer generations, expanding its product offerings and global reach.

In 2021, Krispy Kreme went public again via a special purpose acquisition company (SPAC), returning to the stock market after a period of private ownership. Since then, Krispy Kreme stock has become a focal point for investors interested in the future of the fast-food and consumer packaged goods industry.

Key Factors Affecting Krispy Kreme Stock

- Revenue and Profitability

Krispy Kreme’s revenue growth has been driven by both its brick-and-mortar locations and the expansion of its retail and grocery store partnerships. With increased consumer demand for sweet treats and the brand’s ability to innovate (e.g., offering new doughnut flavors, seasonal items, and other baked goods), Krispy Kreme has positioned itself for steady revenue growth. However, the company faces the ongoing challenge of balancing profitability with the costs of expansion and maintaining high-quality standards. - Expansion and Innovation

Krispy Kreme has been expanding rapidly in international markets, as well as diversifying its offerings. The company has ventured into the coffee business and introduced new doughnut varieties, adapting to changing consumer tastes. Additionally, Krispy Kreme has capitalized on the rise of online delivery and partnerships with popular delivery apps like Uber Eats and DoorDash, which has boosted its presence in the e-commerce sector. - Challenges and Competition

As with any food brand, Krispy Kreme faces intense competition from both global and local chains. Companies like Dunkin’ (now Dunkin’ Brands) and Tim Hortons are formidable players in the doughnut and coffee space. The increasing focus on healthier options and changing dietary preferences could also present a challenge for Krispy Kreme’s traditional indulgence-based business model. Investors should be mindful of these challenges when considering Krispy Kreme stock. - Stock Performance and Valuation

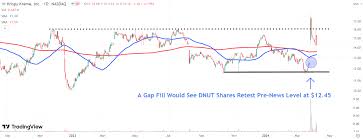

Since its public return, Krispy Kreme stock has seen varying levels of volatility, which is typical of any company trying to grow in a competitive sector. The stock price has fluctuated based on earnings reports, growth projections, and broader market conditions. Analysts have debated the valuation of Krispy Kreme, with some seeing it as a high-growth stock in a niche market, while others believe its price may be inflated due to market hype. Investors need to evaluate the stock’s current valuation and the long-term sustainability of the company’s growth prospects.

Why Invest in Krispy Kreme Stock?

- Strong Brand Recognition

Krispy Kreme is one of the most recognizable doughnut brands in the world. Its iconic status and emotional connection with customers provide a solid foundation for continued brand loyalty and sales growth. The company’s ability to tap into consumer nostalgia, while still innovating with new product offerings, gives it a unique competitive edge. - Global Expansion Opportunities

The international market presents significant opportunities for Krispy Kreme’s growth. While it is already a well-established brand in North America, expanding further into Asia, Europe, and other emerging markets could provide a strong growth trajectory over the next few years. If the company can effectively adapt to local preferences and maintain its quality standards abroad, Krispy Kreme could experience substantial market penetration. - Diversified Product Portfolio

Beyond doughnuts, Krispy Kreme has introduced a range of complementary products, such as coffee, iced beverages, and packaged treats. This diversification not only appeals to a broader customer base but also helps the brand to weather fluctuations in demand for its core products.

Potential Risks to Consider

- Volatility

Like many fast-food and consumer goods stocks, Krispy Kreme stock is subject to market volatility. The company’s dependence on consumer discretionary spending means that it may be impacted by economic slowdowns or changes in consumer behavior. - Health and Dietary Trends

With the growing trend towards healthier eating, indulgent products like doughnuts face increased scrutiny. Krispy Kreme’s traditional product line could be at risk if it fails to adapt to changing dietary preferences, such as low-sugar, low-calorie, or plant-based alternatives.

Conclusion: Is Krispy Kreme Stock a Sweet Investment?

Krispy Kreme stock presents an interesting opportunity for investors looking for exposure to the food and beverage sector, especially given the brand’s global appeal and expansion plans. However, like any investment, there are risks involved, particularly with market volatility and changing consumer habits. Investors should carefully evaluate the company’s financial health, its competitive position in the market, and its ability to navigate challenges before making a decision.

In summary, Krispy Kreme stock has potential, but it’s essential to weigh the opportunities for growth against the risks inherent in the food industry. With a strong brand, innovative product offerings, and expansion strategies in place, Krispy Kreme remains an enticing prospect for those looking for growth in the consumer market—but careful consideration is always advised before adding it to your portfolio.