Deere & Company, widely recognized by its brand name John Deere, has been a cornerstone of agricultural and construction equipment for nearly two centuries. For investors, John Deere stock (NYSE: DE) represents a compelling opportunity to engage with an industry leader driving innovation in sustainable agriculture and advanced technology.

Understanding John Deere Stock

John Deere is a global powerhouse in the manufacture of machinery and equipment for agriculture, construction, and forestry. Known for its iconic green-and-yellow machines, Deere’s stock has become a benchmark for performance in these sectors. Listed on the New York Stock Exchange under the ticker symbol DE, the company consistently attracts attention from long-term and institutional investors.

Key Factors Driving John Deere Stock

- Technological Leadership

John Deere has heavily invested in precision agriculture technologies, including autonomous tractors and GPS-guided equipment. These advancements enhance farm productivity and have positioned the company as a leader in agri-tech. - Sustainable Practices

Deere is focused on reducing environmental impacts through energy-efficient machinery and sustainability-driven innovation. This commitment resonates with ESG-conscious investors. - Global Demand

With a growing global population, the need for advanced agricultural solutions continues to rise. John Deere is strategically positioned to meet the increasing demand for equipment that enables efficient food production. - Economic Sensitivity

While John Deere benefits from robust demand in good economic times, its performance can be cyclical, reflecting fluctuations in commodity prices and farm incomes.

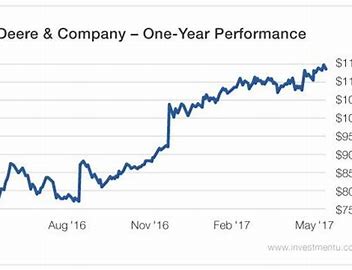

Stock Performance Overview

John Deere stock has demonstrated strong performance over the years, with significant growth driven by innovation and global demand for its products.

Recent Trends:

- Revenue Growth: Deere has reported steady revenue increases, fueled by sales in North America and emerging markets.

- Dividend Stability: DE offers consistent dividend payouts, appealing to income-focused investors.

- Share Buybacks: The company’s commitment to share repurchases enhances shareholder value.

Should You Invest in John Deere Stock?

Strengths:

- Market Leadership: John Deere’s dominant position in agriculture and construction equipment markets ensures long-term relevance.

- Innovation Focus: Investments in cutting-edge technologies and AI-driven equipment provide a competitive edge.

- Dividend Reliability: Deere has a history of stable and growing dividends, signaling financial strength.

Risks:

- Economic Cycles: As a capital-intensive business, John Deere’s revenue is sensitive to economic downturns.

- Commodity Price Dependence: Lower agricultural commodity prices can reduce farmers’ purchasing power and, in turn, equipment demand.

- Supply Chain Challenges: Ongoing global supply chain issues may affect production and delivery.

Why Choose JD Trader for John Deere Stock Investments?

At JD Trader, we empower investors with advanced tools and insights tailored to stocks like John Deere (DE). Whether you’re a seasoned investor or just starting, our platform offers real-time analytics, expert guidance, and innovative solutions to help you make informed decisions.

John Deere stock is a dynamic choice for investors seeking exposure to agricultural innovation and industrial growth. Start your investment journey with JD Trader today and cultivate your financial future with confidence.