Etsy Inc. (NASDAQ: ETSY) has carved out a unique niche in the e-commerce world, specializing in handmade, vintage, and personalized goods. This has made Etsy stock a favorite among investors seeking exposure to the growing online retail space. However, with changing market dynamics and increased competition, understanding Etsy’s stock potential requires a closer look.

Etsy’s Business Model and Market Position

Etsy operates as an online marketplace, connecting millions of sellers with buyers looking for unique products. Its primary revenue sources include transaction fees, seller services, and advertising. Unlike e-commerce giants like Amazon, Etsy’s focus on artisanal and customized goods creates a distinct market position, appealing to both eco-conscious and craft-loving consumers.

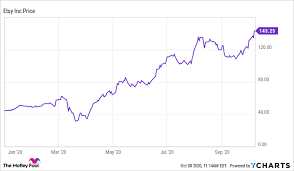

Recent Performance of Etsy Stock

Etsy stock has shown resilience in a highly competitive e-commerce sector. Key performance highlights include:

- Revenue Growth: Etsy reported a 7% year-over-year increase in revenue in Q3 2024, reaching $647 million. This growth was driven by higher seller advertising spend and increased global active users.

- Active Buyer Base: With over 95 million active buyers, Etsy continues to expand its reach. Retention rates among repeat buyers are also strong, highlighting brand loyalty.

Despite these positives, Etsy faces headwinds, including inflationary pressures affecting consumer spending and rising operational costs.

Key Drivers for Etsy Stock

- Expanding E-Commerce Market

The global e-commerce market is expected to grow at a compound annual growth rate (CAGR) of 14.7% through 2030. Etsy’s differentiated business model positions it well to capture a share of this growth, particularly in niche markets. - Personalization Trend

As consumers increasingly seek unique and customized products, Etsy remains a go-to platform. Its focus on sustainability and supporting small businesses resonates with younger, environmentally conscious buyers. - International Expansion

Etsy’s global growth strategy has shown promise, with non-U.S. markets contributing significantly to gross merchandise sales (GMS). Initiatives like localized advertising and enhanced international logistics are driving cross-border transactions. - Etsy Ads and Seller Services

Etsy’s advertising platform, which enables sellers to promote their products, continues to generate strong revenue. The company’s investments in AI-driven search and personalization tools further enhance the shopping experience.

Risks and Challenges

While Etsy stock has growth potential, investors should consider the following risks:

- Economic Sensitivity: As a discretionary spending platform, Etsy is vulnerable to macroeconomic factors like inflation and recessions.

- Competition: Rivals like Amazon Handmade and other niche platforms are intensifying competition, which could limit Etsy’s market share.

- Operational Costs: Rising costs for marketing, logistics, and technology upgrades could pressure Etsy’s margins.

Should You Buy Etsy Stock?

Etsy stock is a promising choice for investors seeking growth in the e-commerce sector, particularly in niche markets. Its innovative business model, strong brand identity, and expansion into international markets offer significant upside. However, it is crucial to monitor macroeconomic conditions and competitive pressures closely.

Conclusion: A Unique E-Commerce Investment Opportunity

Etsy’s distinct focus on handmade and personalized goods sets it apart from other e-commerce players. For investors seeking exposure to a high-growth, niche market, Etsy stock offers an intriguing opportunity. To make informed investment decisions and explore tools tailored to your financial goals, partner with JD Trader, your trusted guide in the world of stocks and investments.