Exxon Mobil Corporation (NYSE: XOM) is one of the largest publicly traded energy companies in the world, making Exxon stock a staple in many investment portfolios. With a history of dividend stability and resilience in fluctuating markets, Exxon Mobil offers both opportunities and challenges for investors.

Overview of Exxon Mobil

Exxon Mobil operates across the energy value chain, from exploration and production (upstream) to refining and marketing (downstream). The company is also investing in renewable energy and carbon capture technologies, aiming to adapt to the global shift toward sustainability while maintaining its dominance in fossil fuels.

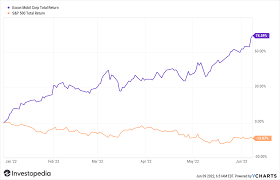

Recent Performance of Exxon Stock

Exxon stock has experienced significant fluctuations over the past few years, influenced by:

- Oil Price Volatility: The stock closely tracks global crude oil prices. Recent increases in oil prices due to geopolitical tensions and supply constraints have positively impacted Exxon’s revenue.

- Strong Earnings Reports: In Q3 2024, Exxon reported $21 billion in earnings, driven by high refining margins and record output from its Permian Basin operations.

Despite these gains, Exxon faces challenges in managing its environmental impact and aligning with shifting energy policies worldwide.

Key Factors Influencing Exxon Stock

- Energy Market Trends

Global demand for oil and gas remains robust, particularly in emerging markets. However, the rise of electric vehicles and renewable energy sources presents long-term challenges for traditional fossil fuel companies like Exxon Mobil. - Dividend Appeal

Exxon is a favorite among income investors, thanks to its history of consistent dividend payouts. Its current yield of approximately 3.5% makes it an attractive choice for those seeking stable returns. - Sustainability Initiatives

Exxon is investing heavily in carbon capture and storage (CCS) technology and hydrogen production. These initiatives not only address climate concerns but also position the company to benefit from government subsidies and incentives for green technologies. - Global Expansion

Exxon’s investments in high-potential regions, including Guyana and Brazil, have significantly boosted its exploration and production capabilities. Guyana, in particular, is becoming a cornerstone for the company’s future growth.

Risks Associated with Exxon Stock

While Exxon stock offers strong upside potential, investors should be mindful of the following risks:

- Regulatory Challenges: As governments worldwide push for decarbonization, stricter regulations on fossil fuel production and emissions could impact Exxon’s operations.

- Price Sensitivity: Exxon’s revenue is highly dependent on oil and gas prices, making the stock susceptible to market volatility.

- Competition from Renewables: The accelerating transition to renewable energy could erode Exxon’s market share in the long term.

Is Exxon Stock a Buy?

Exxon stock is a solid option for investors seeking exposure to the energy sector, particularly those focused on dividend income. Its strong balance sheet, high-margin operations, and ongoing investments in sustainable technologies make it a resilient choice. However, potential investors should weigh the risks of market volatility and regulatory pressures.

Conclusion: A Balanced Perspective on Exxon Stock

As a leader in the global energy sector, Exxon Mobil offers both stability and growth potential. For investors looking to navigate the complexities of energy investing, JD Trader provides expert insights and tools to help make informed decisions. Whether you’re a seasoned investor or new to the market, Exxon stock deserves a closer look for its role in a diversified portfolio.