GameStop Corporation (NYSE: GME) has become one of the most talked-about stocks in recent years, gaining global attention for its unprecedented rise fueled by retail investors. This article delves into the history, key developments, and investment considerations surrounding GameStop stock.

A Brief History of GameStop

Founded in 1984, GameStop is a video game, consumer electronics, and gaming merchandise retailer. While the company once dominated the physical retail gaming market, the rise of digital downloads and online retail significantly challenged its business model. By the late 2010s, GameStop faced financial struggles and declining relevance.

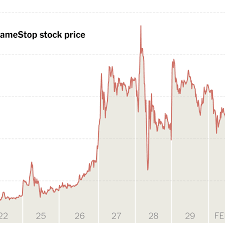

However, in early 2021, GameStop entered the spotlight as a symbol of the retail investing movement, primarily driven by discussions on forums like Reddit’s r/WallStreetBets. Retail investors banded together to drive up the stock price, initiating a short squeeze that caused GME to skyrocket from under $20 to over $400 within weeks.

The Short Squeeze and Market Impact

GameStop’s meteoric rise was fueled by a combination of high short interest from institutional investors and coordinated buying by retail traders. This short squeeze forced hedge funds with significant short positions to buy back shares at higher prices, driving the stock up even further.

This event was pivotal, as it highlighted the growing influence of retail investors and their ability to disrupt traditional market dynamics. GameStop became a cultural phenomenon, symbolizing a clash between Wall Street and Main Street.

Current Developments and Performance

Since the height of the short squeeze, GameStop has undergone significant changes. Key moves include:

- Leadership Restructuring: In 2021, GameStop appointed Ryan Cohen, co-founder of Chewy, as chairman of the board. Cohen has focused on transforming GameStop into a more digital-focused company.

- E-commerce Transition: GameStop is working to shift its business model toward e-commerce and digital gaming services, though the pace of transformation remains a concern for investors.

- Stock Volatility: GME continues to exhibit extreme price volatility, driven by its loyal retail investor base and ongoing speculation.

Investment Considerations for GameStop Stock

- High Risk and Volatility: GME remains one of the most volatile stocks on the market. Its price movements often reflect retail sentiment rather than traditional financial metrics.

- Uncertain Fundamentals: While GameStop’s efforts to pivot to e-commerce are promising, the company faces intense competition and a challenging retail landscape.

- Community and Cultural Impact: GameStop retains a cult-like following among retail investors, making its stock behavior unique.

Conclusion

GameStop stock is a compelling case study of market dynamics, retail investor power, and the impact of community-driven investing. While it remains a risky and speculative investment, its story continues to capture the attention of both the financial world and the broader public.

For investors, GME offers a high-risk, high-reward opportunity, but it is essential to conduct thorough research and consider personal risk tolerance before investing.