Eli Lilly and Company (NYSE: LLY) has long been a prominent player in the pharmaceutical industry, making Eli Lilly stock a popular choice among investors seeking exposure to the healthcare sector. This article delves into the key aspects of Eli Lilly’s stock, including its financial performance, market drivers, and considerations for potential investors.

Overview of Eli Lilly and Its Market Position

Founded in 1876, Eli Lilly is renowned for its innovative medicines addressing diabetes, cancer, immunology, and neurodegenerative diseases. Key products like Trulicity, Jardiance, and Mounjaro have contributed significantly to the company’s revenue growth. With a strong R&D pipeline and a focus on expanding its therapeutic portfolio, Eli Lilly has maintained a leadership position in global pharmaceuticals.

Recent Stock Performance

Eli Lilly’s stock has seen remarkable growth in recent years, driven by:

- Innovative Drug Approvals: The company has secured FDA approvals for promising drugs, boosting investor confidence.

- Global Expansion: Strong performance in emerging markets, especially in diabetes and oncology segments.

- Consistent Revenue Growth: Eli Lilly reported a 28% revenue increase year-over-year in Q3 2024, driven by diabetes care and weight-loss drugs.

The stock’s upward trajectory has also been influenced by investor interest in companies addressing chronic diseases, a market expected to grow significantly in the coming decades.

Market Drivers for Eli Lilly Stock

- Expanding Demand for Diabetes and Obesity Treatments

With the rising prevalence of diabetes and obesity, Eli Lilly’s products like Mounjaro are positioned to capture a substantial share of the market. Analysts predict that global obesity-related therapies could represent a multi-billion-dollar opportunity by 2030. - Robust Research Pipeline

Eli Lilly has invested heavily in research and development, allocating over $8 billion annually. Its pipeline includes innovative treatments for Alzheimer’s disease, autoimmune conditions, and cancer. Recent clinical trial successes have further solidified its growth outlook. - Strategic Acquisitions

The acquisition of companies like Prevail Therapeutics and partnerships with biotechs have enhanced Eli Lilly’s capabilities in gene therapy and precision medicine.

Risks and Considerations

Investing in Eli Lilly stock is not without risks. Key challenges include:

- Regulatory Risks: Drug approvals are subject to stringent FDA scrutiny, and delays could impact revenue projections.

- Patent Expirations: As patents for existing blockbuster drugs expire, generic competition may affect sales.

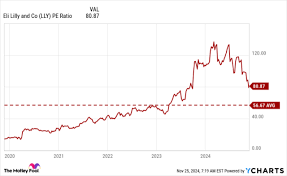

- Valuation Concerns: Eli Lilly’s high valuation relative to peers may deter some investors seeking value stocks.

Is Eli Lilly Stock a Good Investment?

For investors with a long-term perspective, Eli Lilly stock offers an attractive growth story backed by strong fundamentals, a robust product pipeline, and favorable market trends. However, it is crucial to monitor the stock’s valuation and regulatory developments closely.

Conclusion: Why Eli Lilly Stock Stands Out

Eli Lilly stock remains a compelling investment for those seeking exposure to the healthcare and pharmaceutical sectors. With a history of innovation and a clear growth strategy, the company is well-positioned to capitalize on increasing global healthcare needs. For tailored investment advice, visit JD Trader—your trusted partner in navigating the stock market.