Intel Corporation, trading under the ticker symbol INTC, is a powerhouse in the technology industry. As a leading semiconductor company, Intel has been pivotal in shaping the modern tech landscape. This article delves into the key aspects of Intel’s stock (INTC), its market performance, and factors investors should consider before diving in.

Overview of INTC Stock

Intel Corporation is one of the largest semiconductor manufacturers globally, specializing in processors, chips, and integrated circuits for computers and data centers. Founded in 1968, Intel is a pioneer in innovation, consistently driving advancements in technology and maintaining a competitive edge in the global market.

Key metrics of INTC stock include:

- Stock Exchange: NASDAQ

- Sector: Technology

- Market Cap: Over $100 billion

- Dividend Yield: Known for consistent dividend payments, making it attractive for income-focused investors.

Why Invest in Intel (INTC)?

- Established Market Position:

Intel is a household name in semiconductors, with products powering devices across the globe. Its dominance in the market provides stability to investors. - Diverse Revenue Streams:

Intel generates income from multiple sectors, including PCs, data centers, and the Internet of Things (IoT). This diversification mitigates risks associated with market fluctuations. - Commitment to Innovation:

Intel’s investments in AI, 5G, and autonomous vehicle technologies position it as a future-ready company. These areas are poised for exponential growth, providing long-term value for shareholders. - Dividend Payouts:

Intel’s regular and reliable dividends make INTC a favorite among income investors, offering a steady return even in volatile markets.

Performance and Challenges

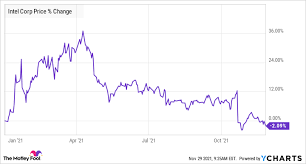

While Intel has historically been a strong performer, it has faced increasing competition from rivals such as AMD and NVIDIA. Recent delays in chip manufacturing advancements have led to concerns about its ability to maintain market leadership. However, Intel’s renewed focus on manufacturing technology and significant investments in fabrication plants signal its intent to reclaim dominance.

Factors to Consider When Investing in INTC Stock

- Industry Trends:

The semiconductor industry is highly cyclical. Stay updated on global demand for chips, government regulations, and supply chain dynamics. - Financial Health:

Analyze Intel’s quarterly earnings reports to understand its profitability, revenue growth, and R&D expenditure. - Competitive Landscape:

Evaluate Intel’s strategies to compete with emerging players and retain its customer base in the face of evolving industry trends. - Long-Term Outlook:

Intel’s strategic investments in AI and advanced manufacturing technologies highlight its potential for sustained growth.

How to Invest in INTC with JD Trader

At JD Trader, we provide cutting-edge tools and expert analysis to help you make informed decisions about stocks like INTC. Our platform offers:

- Real-time stock data and analysis tools for evaluating Intel’s market position.

- Customizable alerts for significant price movements or news updates.

- Educational resources to guide new investors through the complexities of the stock market.

Conclusion

Stock INTC remains a compelling option for investors looking to capitalize on the growth of the semiconductor industry. While Intel faces challenges, its robust market position, innovation-driven strategy, and consistent dividends make it an attractive choice for both growth and income investors.

Explore JD Trader’s platform today to stay ahead in the ever-evolving stock market and make confident investment decisions in stocks like INTC!