Enterprise Products Partners L.P. (NYSE: EPD) is a major player in the midstream energy sector. Known for its extensive pipeline network and reliable dividend payouts, EPD stock has become a popular choice for income-focused investors. This article explores the key factors influencing EPD stock, its financial performance, and its potential as an investment option.

Enterprise Products Partners Overview

Enterprise Products Partners is one of the largest midstream energy companies in North America. Its vast infrastructure includes pipelines, storage facilities, and processing plants that transport and store natural gas, crude oil, and petrochemicals. The company’s focus on fee-based revenues ensures relatively stable cash flows, even in volatile energy markets.

EPD Stock Performance

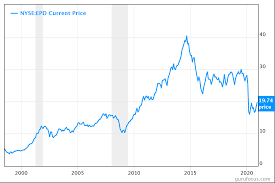

EPD stock has demonstrated resilience and steady growth over the years, making it an attractive investment for those seeking both income and stability. Key performance highlights include:

- Attractive Dividend Yields

EPD is renowned for its consistent and generous dividend payouts, which are highly appealing to income investors. The company has a long history of maintaining and increasing distributions. - Strong Financials

Enterprise Products Partners has consistently delivered solid earnings and cash flow, supported by its diversified portfolio and long-term contracts. Its low debt-to-earnings ratio underscores financial prudence. - Steady Growth in Unit Price

Despite being in a mature industry, EPD stock has shown gradual appreciation in unit price, providing both income and capital gains potential for investors.

Why Consider Investing in EPD Stock?

- Reliable Cash Flow

EPD generates stable cash flow due to its fee-based revenue model. This makes it less susceptible to fluctuations in energy prices compared to upstream energy companies. - Defensive Energy Play

In the energy sector, midstream companies like Enterprise Products Partners serve as a “toll road,” transporting energy commodities and earning fees regardless of market volatility. - Long-Term Contracts

A significant portion of EPD’s business is secured through long-term contracts, providing revenue visibility and reducing operational risk. - Focus on Sustainability

The company is gradually integrating sustainable practices into its operations, including investments in renewable energy and emissions reduction, which aligns with evolving investor priorities.

Risks to Keep in Mind

While EPD stock offers several advantages, it is essential to be aware of the associated risks:

- Regulatory Challenges: The energy industry faces stringent environmental regulations, which could impact operations and profitability.

- Interest Rate Sensitivity: As a master limited partnership (MLP), EPD’s high-yield nature can make it sensitive to rising interest rates.

- Energy Transition Trends: The global shift toward renewable energy may pose long-term challenges for fossil-fuel-dependent businesses.

Is EPD Stock a Good Buy?

EPD stock is particularly attractive for investors seeking stable income through dividends. Its defensive business model, coupled with strong financial health, positions it as a compelling option in the midstream energy sector. However, prospective investors should consider the broader trends in energy markets and weigh the risks associated with regulatory and environmental changes.

Conclusion

Enterprise Products Partners continues to stand out in the midstream energy space due to its robust infrastructure, steady cash flow, and commitment to rewarding shareholders. For those seeking reliable income and moderate growth, EPD stock is a strong candidate to add to a well-diversified portfolio.

At JD Trader, we provide cutting-edge tools and expert insights to help you navigate the stock market. Whether you’re focused on income, growth, or long-term wealth creation, our platform empowers you to make informed investment decisions with ease.