As a leading aerospace giant, Boeing (NYSE: BA) has long been a pivotal player in both commercial and defense aviation. For investors, Boeing stock represents an opportunity to capitalize on a globally recognized brand with substantial market share. However, as with any investment, understanding the company’s financial health, growth drivers, and risks is essential.

Recent Performance of Boeing Stock

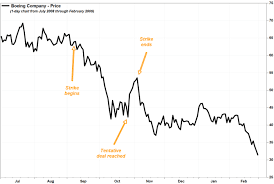

Over the past year, Boeing stock has experienced fluctuations driven by multiple factors, including supply chain disruptions, regulatory scrutiny, and geopolitical tensions. Despite these challenges, Boeing has shown resilience, supported by a rebound in air travel post-COVID and increasing defense contracts.

The stock has seen a mix of gains and pullbacks. While quarterly earnings reports have occasionally missed Wall Street expectations, the company’s revenue growth—particularly from the commercial aviation segment—has instilled cautious optimism among analysts.

Key Growth Drivers

- Commercial Aircraft Recovery

The recovery of the commercial airline industry has been pivotal for Boeing. As airlines replace aging fleets and expand capacity, Boeing’s flagship 737 MAX and 787 Dreamliner remain in high demand. With travel demand forecasted to grow in emerging markets, Boeing stands to benefit from a steady stream of new orders. - Defense and Space Contracts

Boeing’s defense and space division provides a robust revenue stream. Contracts with governments worldwide for military aircraft, satellites, and missile systems shield the company from the cyclical nature of commercial aviation. - Emerging Technologies

Boeing’s investment in innovation, including sustainable aviation fuel (SAF) and electric propulsion systems, aligns with industry trends toward greener aviation. These initiatives not only enhance Boeing’s competitiveness but also attract environmentally conscious investors.

Challenges Facing Boeing Stock

Despite its growth potential, Boeing stock faces several risks:

- Supply Chain Issues: Ongoing delays in parts production, especially for the 737 MAX, impact delivery schedules and profitability.

- Geopolitical Risks: Dependence on international markets, such as China, exposes Boeing to political and trade tensions.

- High Debt Levels: Following the 737 MAX crisis and the pandemic, Boeing’s balance sheet has taken on substantial debt, limiting its financial flexibility.

Investment Outlook

Is Boeing stock a buy? Analysts remain divided. The stock offers potential upside, particularly if the company can streamline production and resolve lingering issues. However, long-term investors should weigh the risks against Boeing’s competitive strengths, including its dominance in a duopoly with Airbus and its role in the defense sector.

Final Thoughts

Boeing stock is a compelling choice for investors seeking exposure to the aerospace industry. While the path forward isn’t without obstacles, Boeing’s recovery story, underpinned by robust demand for aircraft and government contracts, offers significant potential for those with a long-term perspective.

For investors at JD Trader, maintaining a balanced portfolio and conducting thorough due diligence is key when considering an investment in Boeing stock.