Bank of America (NYSE: BAC) has long been one of the leading financial institutions in the United States, and its stock, BAC stock, continues to attract attention from investors. As a key player in the banking sector, Bank of America’s performance offers insight into broader economic trends. Whether you are considering BAC stock as part of your portfolio or simply looking to understand its current market dynamics, this article provides a comprehensive analysis of Bank of America’s investment potential in 2024.

Recent Performance of BAC Stock

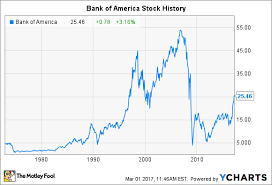

In recent years, BAC stock has seen moderate fluctuations, primarily driven by interest rate changes, economic recovery following the pandemic, and market sentiment surrounding financial stocks. As of late 2024, BAC stock has shown resilience, buoyed by strong earnings reports, solid capital returns, and increasing demand for financial services.

The company’s earnings have benefited from rising interest rates, which allow banks to earn more from their loan portfolios. However, with interest rates now stabilizing and economic conditions uncertain, BAC stock has faced some headwinds. Despite these challenges, Bank of America’s diversified business model, solid balance sheet, and commitment to shareholder returns make it a solid contender for those seeking exposure to the financial sector.

Key Drivers of BAC Stock Growth

- Rising Interest Rates

One of the major drivers for BAC stock in recent years has been the Federal Reserve’s decision to raise interest rates. Higher rates have translated to improved net interest margins (NIM), increasing Bank of America’s profitability from loans and deposits. As the economic recovery continues, the bank stands to benefit from higher yields on loans and mortgages, which could positively impact BAC stock. - Strong Consumer Banking Division

Bank of America’s consumer banking division is a core revenue driver. With a large and diverse customer base, the bank generates significant income from credit cards, mortgages, auto loans, and other services. As the U.S. economy continues to stabilize, demand for these services is expected to remain strong, supporting BAC stock’s growth. - Focus on Technology and Innovation

Bank of America has invested heavily in technology, enhancing its digital banking services and improving the customer experience. The adoption of digital platforms has allowed the bank to reduce costs while providing innovative services that attract younger customers. This focus on digital banking positions BAC stock for long-term growth, especially as tech-driven financial services continue to gain traction. - Capital Returns and Dividends

Bank of America is committed to returning capital to shareholders through stock buybacks and dividends. The company’s strong capital position and consistent profitability allow it to maintain a shareholder-friendly approach. As BAC stock continues to generate healthy returns, these capital distributions provide investors with attractive opportunities for income.

Risks Associated with BAC Stock

While BAC stock has many potential upsides, it is not without risks:

- Economic Slowdown: A potential economic slowdown or recession could impact consumer spending, loan growth, and asset quality, all of which could affect Bank of America’s earnings and the performance of BAC stock.

- Regulatory Changes: As with all financial institutions, BAC stock is sensitive to changes in regulations, including capital requirements, lending regulations, and interest rate policies.

- Competition: Bank of America faces intense competition from both traditional financial institutions and fintech companies. The rise of digital banking and alternative financial products could put pressure on the bank’s margins and market share.

Should You Buy BAC Stock in 2024?

Investors looking for a stable and relatively low-risk stock in the financial sector may find BAC stock appealing. Bank of America offers a diversified portfolio of services, a solid dividend payout, and a strong capital position, which makes it an attractive choice for long-term investors.

However, investors should be aware of the potential risks, particularly in the face of an economic slowdown and changing interest rate environments. As always, a balanced approach is recommended. Those with a higher risk tolerance may consider BAC stock for capital appreciation, while more conservative investors may focus on its dividend yield and stability.

Conclusion

BAC stock remains a top contender for those looking to invest in the financial sector. With its robust business model, growth potential, and commitment to shareholder returns, Bank of America offers solid prospects for both short-term and long-term investors. For clients of JD Trader, evaluating BAC stock should involve consideration of your investment goals, risk appetite, and market outlook. With careful planning, BAC stock could be a valuable addition to your portfolio.