In the fast-paced world of trading and investing, having a reliable method for performing a stock lookup is essential. Whether you’re an experienced investor or a beginner, the ability to quickly and accurately look up stock information allows you to make informed decisions, minimize risks, and seize opportunities in the market. But what does stock lookup actually mean, and how can it be done effectively? Let’s explore this important concept and how you can leverage it for smarter investment strategies.

What is Stock Lookup?

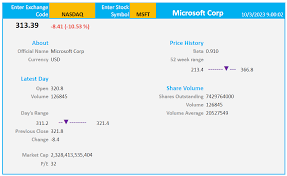

Stock lookup refers to the process of researching and checking information about a specific stock in the market. This includes key data such as the stock’s current price, historical performance, trading volume, market capitalization, and related news. Performing a stock lookup helps investors stay updated on the performance of individual stocks, identify trends, and assess whether to buy, sell, or hold an asset.

For most investors, stock lookup is a routine part of their research before making any trading decisions. With the rapid advancement of online tools and platforms, accessing stock data has never been easier. However, understanding what to look for and how to interpret the data is where many traders find value.

Key Components of Stock Lookup

When performing a stock lookup, there are several crucial data points and metrics that investors typically examine. These include:

- Current Price: This is the most straightforward piece of information in a stock lookup. The stock’s current price represents its most recent market value, and it can fluctuate throughout the day based on market demand.

- Price History: Looking at the stock’s historical price data (such as 1-day, 1-week, or 1-year performance) helps you understand its volatility, trends, and long-term potential.

- Volume: This represents the number of shares traded during a specific period. A sudden spike or drop in trading volume can signal strong investor interest or a significant event affecting the stock.

- Market Capitalization: The market cap is a company’s total value in the stock market, calculated by multiplying the stock’s current price by the total number of outstanding shares. This provides a sense of the company’s size, stability, and growth potential.

- Earnings Reports and Financials: Investors use quarterly earnings reports to gauge a company’s financial health, including revenue, profit margins, and guidance for the future. This information can significantly affect stock prices.

- News and Sentiment: Stock lookup tools often include news feeds that provide up-to-the-minute information about the company. News such as product launches, leadership changes, legal issues, or regulatory updates can all have a direct impact on stock performance.

- Technical Indicators: For more experienced traders, tools like moving averages, Relative Strength Index (RSI), and support/resistance levels are important components of a stock lookup. These indicators help identify entry and exit points, as well as trends.

How to Perform an Efficient Stock Lookup

Performing a stock lookup can be done through various resources, ranging from financial news websites to sophisticated stock trading platforms. Here’s a step-by-step guide to ensure an efficient stock lookup process:

- Use Reputable Platforms: Make sure to use trusted sources, such as major financial news websites (e.g., Bloomberg, Yahoo Finance) or stock trading platforms (e.g., JD Trader, TD Ameritrade, E*TRADE). These platforms offer real-time data, charts, and analysis tools.

- Filter for Key Metrics: Focus on the key metrics that align with your investment strategy. Are you looking for growth stocks, dividend yield, or value stocks? Tailoring your search criteria ensures you’re looking at stocks that meet your specific needs.

- Look Beyond the Price: Don’t make decisions based solely on the stock’s price. While price is an important factor, you should also take into account the company’s fundamentals, financial health, and market outlook.

- Stay Updated with News: Stock prices can be heavily influenced by news events. Set up alerts for the companies you’re tracking to stay informed of any relevant news or updates that might affect their performance.

- Check for Analyst Ratings: Many stock lookup tools include analyst ratings, which can provide insights into whether experts believe a stock is a “buy,” “hold,” or “sell.” These can be a helpful addition to your analysis.

Why Stock Lookup is Important for Investors

Stock lookup provides investors with the ability to monitor their portfolios, make adjustments, and stay ahead of market trends. Some of the key reasons why stock lookup is crucial include:

- Real-Time Information: Stock prices and market conditions can change rapidly. By performing a stock lookup, you ensure that you are making decisions based on the latest data available.

- Informed Decision-Making: Whether you’re deciding to buy or sell, conducting a thorough stock lookup helps you avoid knee-jerk reactions and emotional decisions, leading to more calculated and confident moves.

- Risk Management: A detailed stock lookup allows you to assess the risk associated with a particular investment. For example, understanding a stock’s volatility and trading volume can help you decide whether the potential return justifies the risk.

Conclusion

In the ever-evolving world of stock trading, performing a stock lookup is a vital skill for any investor. By understanding what key metrics to monitor and knowing how to use stock lookup tools effectively, you can make smarter investment decisions, minimize risks, and improve the performance of your portfolio.

At JD Trader, we provide you with the tools and resources needed to perform efficient stock lookups, offering real-time data, market analysis, and expert insights to help you navigate the complexities of the stock market. Whether you’re a beginner or a seasoned trader, having access to the right stock lookup features is essential for success in today’s dynamic market.