As a reliable platform for informed investors, JD Trader dives deep into Coca-Cola’s stock, widely recognized by its ticker symbol, KO. For decades, Coca-Cola has been a staple in portfolios, offering steady growth, reliable dividends, and resilience across economic cycles. Let’s analyze what makes KO stock a compelling investment choice in today’s dynamic market.

KO Stock Performance and Historical Resilience

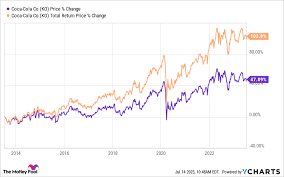

KO stock has consistently demonstrated strong performance. Over the past decade, Coca-Cola has achieved stable revenue growth through strategic acquisitions, brand diversification, and global market penetration. Its dividend aristocrat status—with over 60 years of consecutive dividend increases—makes it particularly appealing to income-focused investors.

Historically, Coca-Cola’s stock has shown remarkable resilience, even during recessions. The brand’s strong global presence and its position as a consumer staple help insulate it from economic downturns. For example, during the COVID-19 pandemic, while many companies struggled, KO maintained steady cash flows, underscoring its defensive characteristics.

Growth Drivers for KO Stock

- Brand Portfolio Expansion: Beyond traditional sodas, Coca-Cola has aggressively expanded its portfolio to include healthier beverages, energy drinks, and premium water brands. This diversification aligns with changing consumer preferences and opens new revenue streams.

- Sustainability Initiatives: Coca-Cola’s commitment to sustainability, including its World Without Waste initiative, enhances its brand reputation, attracting socially conscious investors and consumers.

- Emerging Markets: KO’s penetration into emerging markets, such as India and Southeast Asia, presents significant growth opportunities. The rising middle class in these regions is driving demand for branded beverages.

- Technological Integration: By leveraging AI and data analytics, Coca-Cola optimizes its supply chain, marketing strategies, and product innovation, further boosting operational efficiency and profitability.

Risks to Consider

While KO stock offers stability, potential risks include regulatory challenges, fluctuating raw material costs, and competitive pressures from other beverage companies. Additionally, shifting consumer attitudes towards sugary drinks pose challenges, but Coca-Cola’s diversification efforts mitigate these risks.

Why KO Stock Belongs in Your Portfolio

For investors seeking a balance of growth and stability, KO stock stands out. Its defensive nature, coupled with consistent dividend payouts, makes it an attractive option for both seasoned investors and those new to the market. At JD Trader, we recommend considering KO as a core holding in a diversified portfolio.

Conclusion

Coca-Cola’s KO stock exemplifies the strength of an enduring brand. Whether you’re a growth-oriented investor or someone prioritizing dividend income, KO offers a well-rounded investment opportunity. Stay tuned to JD Trader for further insights into KO stock and other market-leading companies.