Staying updated on stock gainers is critical for investors aiming to capitalize on market opportunities. These stocks, which experience significant price increases within a day, week, or month, often reflect strong market sentiment or positive developments within the company or industry. At JD Trader, we provide tools and insights to help you analyze stock gainers and make informed investment decisions.

What Are Stock Gainers?

Stock gainers are equities that have experienced a significant price rise within a given timeframe. They are categorized as:

- Daily Gainers: Stocks with the highest percentage gains during the trading day.

- Weekly/Monthly Gainers: Companies showing consistent upward trends over longer periods.

Why Track Stock Gainers?

- Spot Market Trends: Gainers often highlight emerging sectors or industries experiencing growth.

- Identify Investment Opportunities: Stocks with strong upward momentum may offer profitable entry points.

- Gauge Market Sentiment: Positive movement in stock prices reflects investor confidence, signaling potential growth areas.

Factors Driving Stock Gainers

Several factors can propel stocks to the top of the gainers’ list:

- Earnings Announcements: Strong quarterly or annual financial results can drive substantial price increases.

- Market News: Mergers, acquisitions, product launches, or favorable policy changes can significantly impact stock performance.

- Sector Trends: Stocks in trending industries like technology, healthcare, or green energy often outperform during favorable periods.

- Technical Breakouts: Stocks breaking through resistance levels can attract increased investor attention.

How to Analyze Stock Gainers

To maximize your returns, it’s essential to evaluate gainers critically:

- Understand the Context: Analyze the reasons behind the price surge. Is it due to company performance, market speculation, or external factors?

- Review Fundamentals: Ensure the company’s financial health aligns with its stock’s performance.

- Monitor Volume: Stocks with high trading volume during price surges often indicate genuine investor interest.

- Check Sustainability: Distinguish between short-term speculation and long-term growth potential.

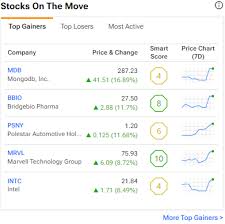

Example of Recent Stock Gainers

For instance, a tech company might surge 15% in a single day after reporting record-breaking profits and issuing a robust forecast. Similarly, an energy firm could lead gainers due to a major government contract win, driving investor confidence in the sector.

Tools and Resources at JD Trader

JD Trader empowers investors with:

- Real-Time Data: Stay updated on top stock gainers across global markets.

- In-Depth Analysis: Get expert insights into why a stock is gaining and its future potential.

- Custom Alerts: Receive notifications for stocks matching your investment criteria.

Conclusion

Tracking stock gainers is an essential strategy for investors seeking to stay ahead in volatile markets. These stocks provide a window into the market’s top-performing areas, offering valuable insights for both short-term and long-term investment strategies.

Let JD Trader guide your journey through the world of stock gainers with data-driven tools and expert advice. Start exploring the leaders of tomorrow’s markets today!