Dell Technologies, traded under the ticker DELL, is a prominent player in the technology sector, offering a diverse range of products and services, from personal computers to enterprise solutions. As the world increasingly relies on digital infrastructure, Dell’s position in the market makes it an attractive option for investors seeking exposure to the tech industry. This article examines the performance, strengths, and key considerations for investing in Dell stock.

Overview of Dell Technologies

Dell Technologies operates across multiple segments, including:

- Client Solutions Group (CSG): Focused on personal computers, laptops, and accessories, contributing a significant portion of Dell’s revenue.

- Infrastructure Solutions Group (ISG): Provides servers, storage, and networking solutions, catering to enterprise clients.

- VMware Spin-Off: While VMware was a major part of Dell, its spin-off in 2021 has allowed Dell to focus on its core hardware and infrastructure offerings while maintaining a strategic relationship with VMware.

This diversification enables Dell to capture revenue from both consumer and enterprise markets, offering resilience in fluctuating market conditions.

Performance of Dell Stock

Dell has demonstrated consistent growth, leveraging its strong brand and market presence. Key trends include:

- Pandemic Surge: The COVID-19 pandemic boosted demand for laptops and remote work solutions, positively impacting Dell’s revenue.

- Post-Pandemic Stabilization: While consumer demand normalized, enterprise solutions and infrastructure services have continued to grow.

- Strong Earnings: Dell has shown robust financial performance, with steady revenue and profit growth in recent years.

However, like other tech companies, Dell stock faces volatility due to macroeconomic factors, such as rising interest rates and global supply chain disruptions.

Why Invest in Dell Stock?

- Strong Market Position

Dell is a leader in personal computers and enterprise solutions, consistently ranking among the top PC manufacturers worldwide. - Enterprise Growth Potential

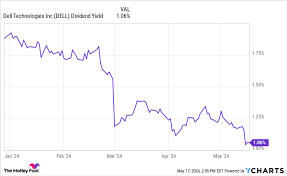

The increasing adoption of cloud computing, edge computing, and data storage solutions positions Dell to benefit from enterprise IT spending. - Shareholder Returns

Dell has initiated a dividend program and share buybacks, signaling confidence in its financial stability and commitment to returning value to shareholders. - Valuation

Compared to some high-growth tech companies, Dell stock often trades at a reasonable valuation, appealing to value-oriented investors.

Risks of Investing in Dell Stock

- Consumer Market Dependence

The PC market is cyclical, and declining consumer demand for personal computers could impact Dell’s revenue. - Supply Chain Challenges

As a hardware manufacturer, Dell is exposed to risks like component shortages and rising production costs. - Competition

Dell competes with major tech players such as HP, Lenovo, and Apple in the PC market, as well as companies like Cisco and IBM in enterprise solutions. - Debt Levels

Following its acquisition of EMC Corporation in 2016, Dell carries a significant debt load, which may limit its financial flexibility.

Key Metrics for Dell Stock Analysis

Before investing in Dell stock, evaluate these financial and operational metrics:

- Price-to-Earnings (P/E) Ratio: Compare Dell’s valuation to industry averages.

- Revenue Growth: Assess growth in both consumer and enterprise segments.

- Dividend Yield: Consider the income potential from Dell’s dividend payouts.

- Debt-to-Equity Ratio: Monitor Dell’s ability to manage its debt obligations.

JD Trader: Your Trusted Partner in Stock Investing

At JD Trader, we provide the tools and resources you need to make informed investment decisions about Dell stock and other technology leaders. Our platform offers:

- Real-time stock data and analysis.

- Insights into industry trends shaping the technology sector.

- Portfolio management tools to optimize your investments.

Conclusion

Dell stock presents a compelling opportunity for investors seeking exposure to the tech sector. With its strong market position, diversified revenue streams, and enterprise growth potential, Dell is well-positioned for the future. However, investors should carefully consider the risks, including market competition and supply chain challenges.

For actionable insights and expert support, partner with JD Trader today. Explore the potential of Dell stock and build a portfolio designed for long-term success.