Shopify stock (NYSE: SHOP, TSX: SHOP) has been a favorite among investors, thanks to its leadership in e-commerce solutions. As more businesses shift to online sales, Shopify’s platform remains a key player in the digital economy. But is SHOP stock still a good investment in 2024? Let’s analyze its performance, growth potential, and risks.

Shopify (SHOP): Company Overview

Founded in 2006, Shopify provides cloud-based e-commerce solutions that help businesses of all sizes create and manage online stores. The company offers a wide range of services, including:

✔ Website & Storefront Management – Easy-to-use tools for building e-commerce stores.

✔ Payment Processing (Shopify Payments) – Integrated solutions for seamless transactions.

✔ Logistics & Fulfillment (Shopify Fulfillment Network) – Support for faster product delivery.

✔ AI and Automation Features – Tools to enhance marketing, sales, and customer engagement.

With e-commerce continuing to expand, Shopify’s platform is well-positioned for long-term growth, making Shopify stock a strong contender for investors seeking exposure to digital commerce.

Shopify Stock Performance & Financial Health

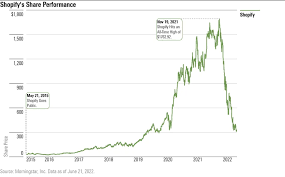

1. Recent Stock Price Trends

SHOP stock has experienced strong growth in 2023 and early 2024, recovering from previous market downturns. The key drivers include:

📌 Increased demand for online shopping and digital commerce.

📌 Expansion of Shopify’s AI-powered tools and enterprise solutions.

📌 Revenue growth from merchant subscription services.

2. Revenue and Profitability

Shopify has maintained solid revenue growth, driven by:

✅ Merchant Solutions Revenue – Fees from transactions, shipping, and financial services.

✅ Subscription Revenue – Monthly and annual plans for businesses using Shopify’s platform.

✅ Shopify Plus – Premium services for larger enterprises, boosting higher-margin revenue.

3. Key Financial Metrics

- Market Cap: Over $80 billion (as of 2024).

- Revenue Growth: Double-digit increases year-over-year.

- Profitability: Shopify has improved margins, reducing operating losses.

Why Investors Are Bullish on Shopify Stock

1. E-commerce Growth Continues

The global e-commerce market is projected to grow significantly, with Shopify benefiting from:

📈 More small businesses shifting to online sales.

📈 Increased adoption of mobile shopping and social commerce.

📈 Expansion into international markets.

2. AI & Automation Driving Innovation

Shopify has integrated AI-powered tools to improve merchant sales and customer experience. Features like Shopify Magic (AI-driven marketing content) and automated inventory management help businesses scale efficiently.

3. Expansion in Enterprise & B2B Commerce

While Shopify is known for small and medium-sized businesses, it is expanding into enterprise e-commerce with Shopify Plus and partnerships with major brands. This shift increases its revenue potential and strengthens Shopify’s competitive position.

Risks & Challenges for Shopify Stock

While Shopify has strong growth potential, there are challenges investors should consider:

🚨 Macroeconomic Risks – Slower consumer spending or economic downturns could impact online sales.

🚨 Competition – Shopify faces competition from Amazon, WooCommerce, Wix, and BigCommerce.

🚨 Profitability Concerns – While revenue is strong, Shopify is still working to improve long-term profitability.

Is Shopify Stock a Good Buy in 2024?

Bull Case for SHOP Stock

📈 Strong revenue growth driven by e-commerce expansion.

📈 AI and automation improving merchant sales and efficiency.

📈 Increased adoption of Shopify Plus for larger businesses.

Bear Case for SHOP Stock

📉 Competition from Amazon and other e-commerce platforms.

📉 Profitability still a concern despite revenue growth.

📉 Economic conditions could impact consumer spending.

Final Verdict: Shopify stock remains a strong long-term investment, but investors should watch financial reports and industry trends closely.

Conclusion

Shopify stock (SHOP) continues to benefit from e-commerce expansion, AI-driven innovations, and growing enterprise adoption. Despite competition and market fluctuations, Shopify’s strong position in digital commerce makes it an attractive option for long-term investors.

🚀 Stay ahead with JD Trader for expert insights and real-time SHOP stock updates!