In the world of stock trading and investment research, the term “stock overweight” is commonly used by analysts and financial institutions to provide insights into a stock’s expected performance. But what does “stock overweight” really mean, and how should investors interpret this rating? In this article, we will explore the meaning of stock overweight, its implications, and how it can guide investment decisions.

What Does Stock Overweight Mean?

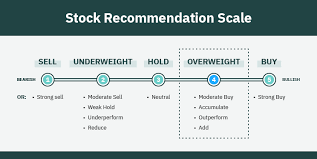

A stock is labeled as overweight when an analyst or financial institution believes that it will outperform the market or a specific benchmark index. This recommendation typically suggests that investors should allocate a higher proportion of their portfolio to this stock compared to others in the same sector or index. The overweight rating is part of a broader stock rating system that includes:

- Overweight – The stock is expected to perform better than the market average.

- Equal Weight – The stock is expected to perform in line with the market.

- Underweight – The stock is anticipated to underperform compared to the market.

Why Do Analysts Assign an Overweight Rating?

Investment analysts base their overweight recommendations on various factors, including:

- Strong Fundamentals – If a company has solid earnings, revenue growth, and a strong balance sheet, it may receive an overweight rating.

- Industry Trends – Stocks in rapidly growing industries, such as technology or healthcare, are more likely to be rated overweight.

- Macroeconomic Factors – Favorable economic conditions, government policies, or global trends can influence a stock’s rating.

- Valuation Metrics – Analysts compare a stock’s price-to-earnings (P/E) ratio, price-to-book ratio, and other valuation metrics to determine if it is undervalued or poised for growth.

How Should Investors React to an Overweight Rating?

While an overweight rating signals a positive outlook, investors should consider the following before making investment decisions:

- Do Your Own Research – Analysts’ ratings are helpful, but it’s crucial to conduct independent research to understand the company’s fundamentals and potential risks.

- Diversification Matters – Even if a stock is rated overweight, it’s important to maintain a well-balanced portfolio to manage risk.

- Consider Your Investment Goals – Investors should assess whether the stock aligns with their financial objectives, risk tolerance, and time horizon.

- Monitor Market Conditions – A stock’s overweight rating can change over time based on market shifts, earnings reports, or economic developments.

Overweight vs. Buy: What’s the Difference?

While “overweight” and “buy” may seem similar, they are not always interchangeable. A buy rating is a direct recommendation to purchase a stock, while an overweight rating suggests that the stock should have a larger allocation in a portfolio relative to a benchmark index.

Final Thoughts

Understanding the meaning of stock overweight can help investors make more informed decisions when analyzing stock ratings. While an overweight rating indicates potential outperformance, it should not be the sole basis for investment decisions. By combining analyst recommendations with personal research, risk assessment, and portfolio diversification, investors can optimize their trading strategies for long-term success.

For expert insights, advanced trading tools, and professional guidance, JD Trader is here to help you navigate the stock market with confidence. Start making informed investment decisions today!